French Motorcycles Market is steady. In 2023 sales have been 305.719 (+2.0%) one of the weaker performance in Europe. Honda overtakes Yamaha and is the new leader, while BMW ranks third.

French Motorcycles Industry Trend and Perspectives

The introduction of new rules for 2-wheeler circulation in the metropolitan cities, starting from Paris, is evolving the industry and creating some disappointing among customers. This is probably one of the reason for the delay of EV market growth and the consequent steady speed taken by the market overall.

Indeed, while other European 2-Wheeler markets in recent years have shown a growing tendency, the French market looks almost steady, as confirmed by the last year result.

Indeed sales have been 305.719 (+2.0%) one of the weaker performance in Europe.

While the motorcycle segment performed up 11.1%, the scooter segment declined 10.7%.

Electric segment declined both in L1 segment (-15.3%) and L3 (-12.3%.

Looking at top manufacturer’s performance, Honda has taken the leadership with sales up 39.4% overtaking Yamaha, thanks to the strong demand on PCX125, X-ADV 750 and CRF1100 Africa Twin.

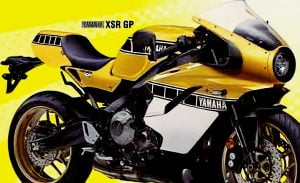

In second place Yamaha, gaining 7.7% of sales for the top selling model, the Xmax 125.

In third place BMW up 1.0% while in 4th place Peugeot lost 3.6%, but overtook Piaggio, which was 5th (-11.1%).

Outstanding performance by Kawasaki (+28.5%), KTM (+27.4%), Suzuki (+34.7%), Zontes (+32.8%).